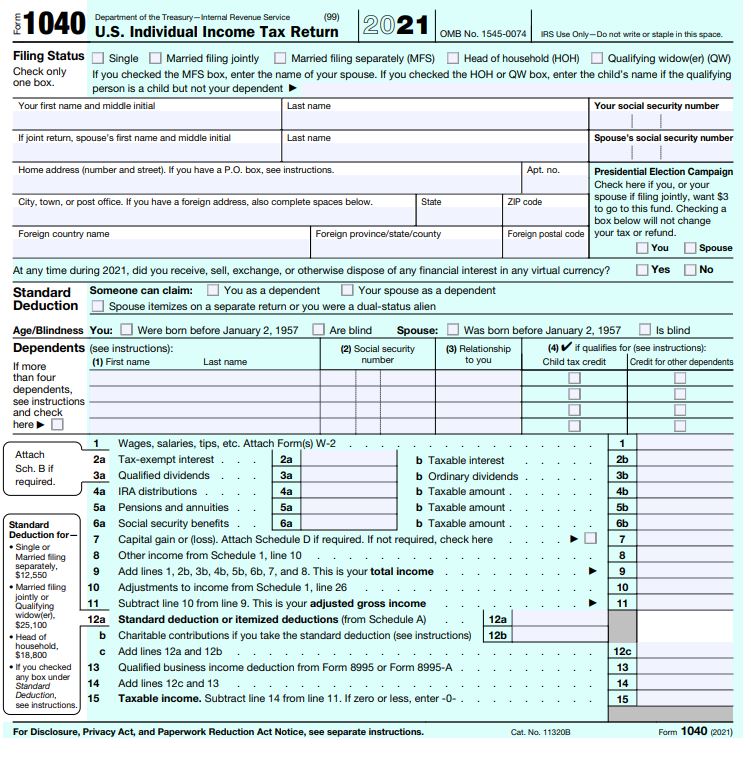

INDIVIDUAL INCOME TAX PREPARATION

We have significant experience with basic 1040s to complex 1040s with rental properties, stock transactions, and business income earned across multiple states. We also have experience with high net-worth clients where we conduct year-round tax planning with a focus on compliance, avoiding audits, and minimizing tax liabilities. You can count on us to provide superior client service and direct involvement with a licensed CPA. Our goals are to serve and assist you in completing your financial goals on a long-term basis.

TYPES OF INDIVIDUAL TAX RETURNS

Simple Individual Tax Returns – The most common types of tax returns are basic 1040s that include a few W2s or 1099s with little to no expenses. The would also include returns with some stock transactions and potentially an itemized deduction schedule.

Complex Individual Tax Returns – These types of tax returns are 1040 returns that include additional schedules, such as, a business profit and loss schedule, a rental property schedule, partnership income, S-Corp income, significant stock transactions, business investments, etc.

High-Net Worth Individual Tax Returns – These types of tax returns are 1040 returns that are typically complex returns, but also include a year-round tax planning approach with a focus on compliance, avoiding audits and minimizing tax liabilities.

MOST COMMON INDIVIDUAL RETURN ISSUES

Multiple State Return – These can get complicated are when you run into issues with filing in multiple states or localities. These situations arise when you live in one state but work in another, or if you move during the year. To do these properly, you will need to know where to allocate the income earned, as well as the tax law in the respective tax authority.

1099 Income – Often our clients will get a 1099 with a substantial amount of money and get worried they will owe a substantial amount of taxes to the IRS. Remember, in this instance, you will only pay tax on your net profit, and not your gross income. You will need to keep track of your expenses in order to appropriately file your return at the end of the year.

Cryptocurrency Income – There are many issues surrounding the reporting of cryptocurrency income. The IRS is really starting to flag these returns, and in order to file these types of returns correctly, you will need to stay current on the most recent IRS guidance.

AG Consulting - Why Choose Us?

- We have a licensed CPA that reviews and signs every return that leaves this office.

- Since we are based in the tri-state area, we serve many clients that have multiple state returns. For that reason, our extensive experience will ensure that your return is prepared and filed correctly with each taxing authority.

- Our staff CPA has prepared numerous personal returns with 1099 income, as well as, cryptocurrency income. We serve many clients that fall into these areas, so we are always keeping current with the most recent guidance issued by the IRS.

- We work directly with financial advisors to tax plan for our high net-worth clients and serve many clients in this area as well.