BUSINESS TAX PREPARATION

We have significant experience with closely held family businesses, and work hand in hand with business owners to understand your business at every level. This allows us to provide a higher level of service by consulting with you on any accounting or business issues. Direct involvement of a licensed CPA that will be able to assist you with compliance, tax preparation, and consulting is what separates us from our competition.

TYPES OF BUSINESS TAX RETURNS

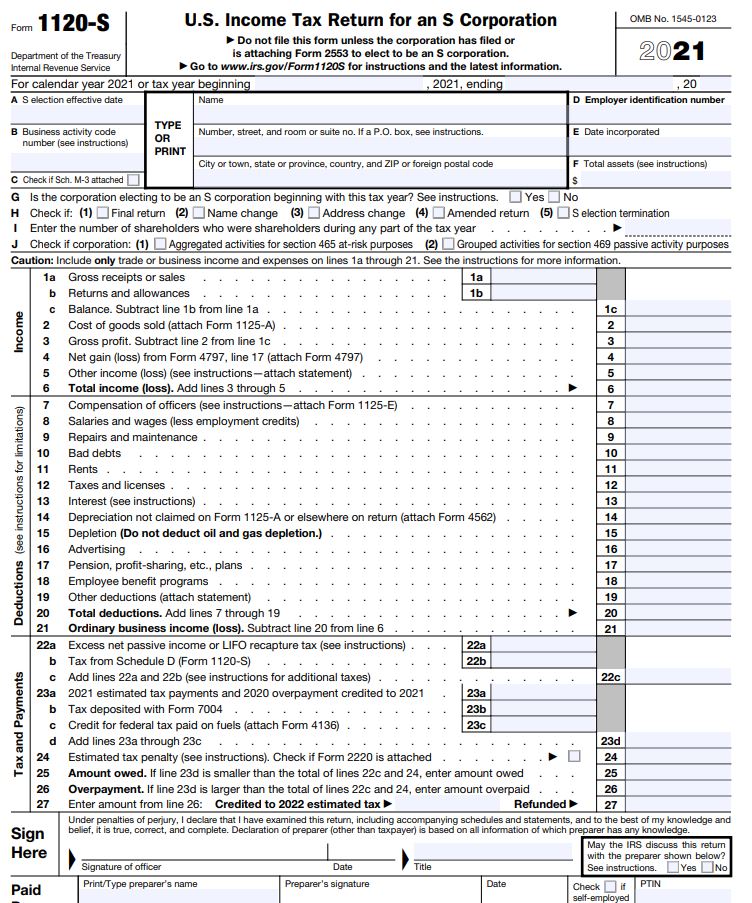

1120S – Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation of business income.

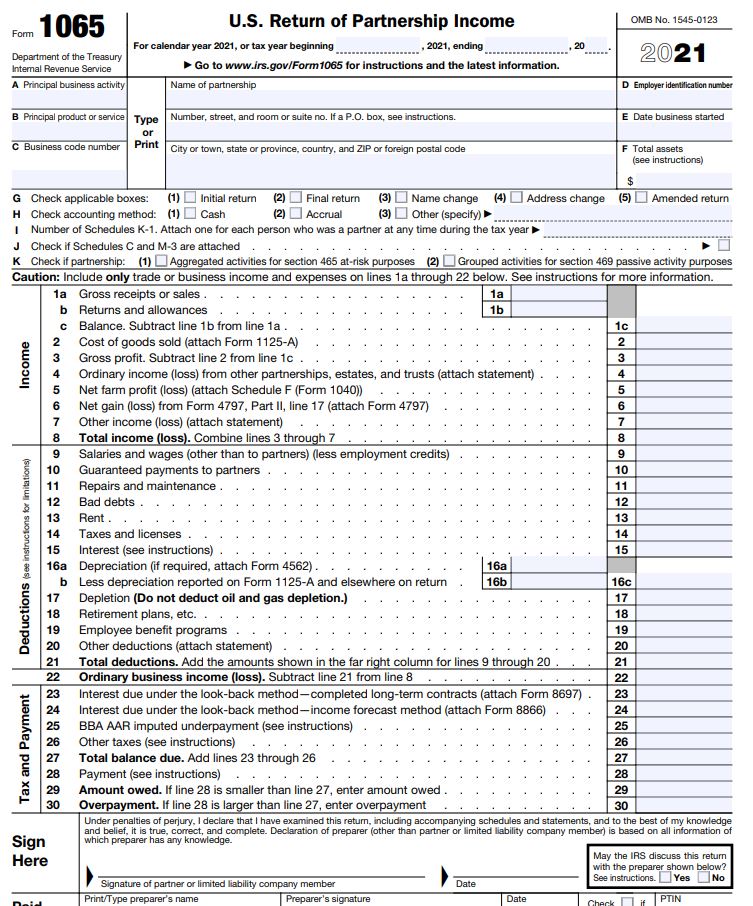

1065 – These are for a partnership, which is a relationship between two or more people to do trade or business. Each person contributes money, property, labor or skill, and shares in the profits and losses of the business.

MOST COMMON BUSINESS RETURN ISSUES

Complexity – Business returns can be complicated and complex and if you do not have experience with them, then you should consult with a qualified tax professional. We have seen many issues with unqualified preparers making mistakes on business returns that leads to over/understatements of income and potentially an IRS audit.

Book to Tax Adjustments – One of the most complicated issues with preparing business returns is reconciling book to tax income on schedule M-1. Due to the differences between tax law and standard accounting rules, some differences can arise between book and tax income. An example of this would be meals and entertainment deductions, for IRS purposes only 50% can generally be deducted, but for book purposes it should 100% deducted. This is one of several examples of complicated rules that should be reviewed by qualified professionals.

Capital Accounts and Distributions – When you have a partnership or S-Corp, the way you get paid is a little different then if you are you self-employed and filing a P&L on your personal return (Schedule C). With business returns, you will get taxed, on your business income, directly on your personal return and then be able to tax distributions from the business in the future. Whether those distributions are taxable or not has to deal with your basis, or capital account, in the company. Making sure this area of your business return is completed properly is crucial to your tax liability.

AG Consulting - Why Choose Us?

- We have a licensed CPA that reviews and signs every return that leaves this office.

- Our staff CPA has prepared numerous business returns and has over 10 years of experience in tax and business valuation.

- We work directly with business owners to ensure that the returns are filed timely and correctly with the appropriate taxing authorities.